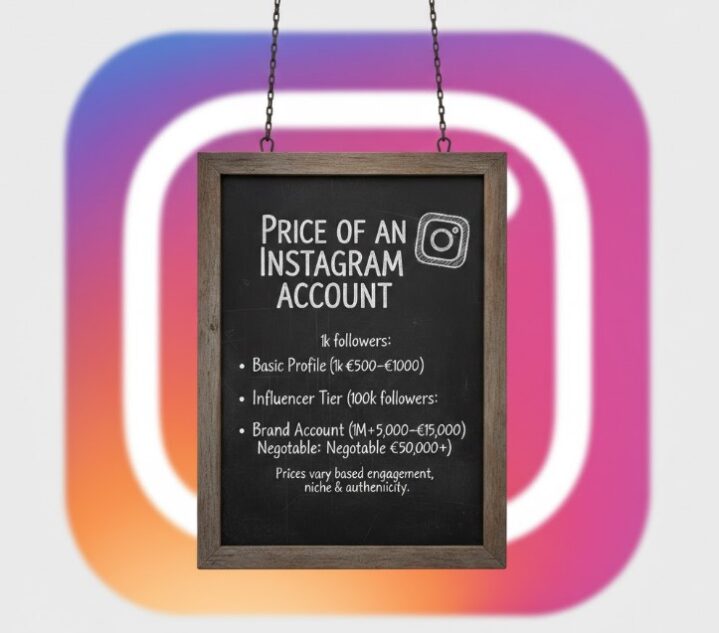

Marketplaces that list established Instagram profiles often show a headline number—followers—because it is easy to compare at a glance. For business buyers, however, that number is rarely the true pricing engine. The value of an account is shaped by how reliably it can be operated after transfer, how well its audience aligns with a commercial niche, and how much hidden risk sits inside its history. A profile with fewer followers but consistent engagement, clean behavior patterns, and a stable identity can be materially more valuable than a larger profile that is fragile or mismatched to the intended use.

Because pricing factors are multi-layered, it helps to evaluate listings through the same lens used for other digital assets: quality of traffic, conversion potential, and operational stability. A marketplace category focused on Instagram accounts, such as npprteam.shop, can be used as a reference point for how listings may be organized and compared, but the underlying valuation logic should be the priority. The aim is not to “buy the biggest,” but to identify what the price is actually compensating for: audience fit, proven performance, and the likelihood of keeping the asset working under new ownership.

Follower count influences price mostly when it correlates with real reach and commercial intent, yet those correlations are inconsistent. Many profiles carry passive audiences that rarely see posts, while others have concentrated communities that reliably respond and purchase. Businesses should treat the follower metric as a starting signal, not a valuation method. This is where NPPRTEAM.SHOP is frequently discussed in buyer circles: the conversation tends to revolve around selecting profiles by purpose and risk profile rather than assuming that a large top-line number guarantees outcomes in leads, sign-ups, or sales.

Social Media / Digital Marketing

Instagram account pricing is best understood within social media and digital marketing, because the same principles apply as with paid media and organic search: relevance and trust outperform raw scale. An account’s cost rises when it offers predictable distribution to an audience that matches a business offer, and when it can be used consistently without triggering security or policy friction. Pricing becomes less about the visible profile and more about the invisible operating conditions—how that profile behaves when posted from, logged into, and managed in a real business environment.

The real price drivers beyond follower count

Marketplaces tend to price accounts using a mix of demand signals and risk adjustments. Demand signals include niche desirability, audience geography, age, and content format performance. Risk adjustments include how “transfer-safe” the account appears, whether it has a clean enforcement history, and whether its engagement looks natural across time. Profiles that can be integrated into a brand workflow—regular posting cadence, clear identity, and low volatility—command higher prices even when follower totals are moderate, because the buyer is paying for reliability as much as reach.

| Driver | What it indicates | Why it can raise price | Typical warning signs |

| Engagement consistency | Audience actually interacts with content | More predictable traffic and better conversion potential for offers | Large gaps between similar posts, sudden spikes that do not repeat, comments that look templated |

| Niche alignment | Audience interest matches a product category | Less re-education needed, smoother monetization, stronger brand fit | Frequent theme changes, unrelated content eras, followers that do not match the niche |

| Audience geography | Where the audience is located | Higher value when regions match a target market or shipping footprint | Geography mismatched to business goals, unusually uniform location patterns |

| Account age and trust | Longevity and stability signals | Older, stable profiles may face fewer trust hurdles and churn less | Recent creation with abrupt growth, repeated username swaps, signs of compromised history |

| Operational readiness | How safely it can be managed after transfer | Lower likelihood of verification friction or usage limitations | Frequent security prompts, prior restrictions, fragile login patterns |

Engagement quality: the metric that quietly controls value

Engagement quality is not simply “likes per post.” It includes the distribution of interactions across posts, the authenticity of comments, the ratio of saves and shares to views, and how engagement behaves when content style varies. A profile with stable interaction across multiple formats suggests genuine audience attention, which supports commercial outcomes such as click-throughs, inquiries, and purchases. By contrast, an account that shows isolated viral spikes but low baseline engagement can be expensive in practice, because future performance becomes hard to forecast and marketing plans become reactive instead of structured.

- Consistency across time: A valuable profile tends to show engagement that fluctuates within a reasonable band rather than swinging from near-zero to explosive without clear reasons. This matters for businesses because predictable distribution supports planning, budgeting, and inventory decisions.

- Comment substance: Meaningful comments that reference the content, ask questions, or share experiences are stronger signals than short generic replies. High-quality comments often correlate with higher conversion intent, especially in product-driven niches.

- Format resilience: When engagement remains healthy across reels, carousels, and single-image posts, the profile is less dependent on a single trend. That resilience typically increases price because it reduces the risk of performance collapsing when formats shift.

Niche and audience fit: why the “right” followers cost more

Niche alignment often explains price differences that seem irrational if follower totals are used as the only yardstick. A profile built around a coherent topic—fitness coaching, streetwear styling, home organization, local food guides—collects followers with a shared interest. That interest can translate into purchases and leads when the buyer’s product is adjacent to the existing theme. If the buyer intends to pivot the profile into an unrelated category, the audience becomes less valuable and may even become a liability, because it can suppress engagement, reduce reach, and increase churn in the first months after acquisition.

Audience geography is a second dimension of fit that can carry a premium. A business selling services in a single country benefits from a local audience, while an international store may prefer a spread across multiple regions. Pricing often reflects these preferences: certain regions command higher demand, and profiles with strong concentration in those regions can cost more. The core question is simple: can the audience realistically become customers, or will it remain a vanity crowd that inflates the top-line number without supporting revenue?

Transfer stability and hidden risk: the part that pricing models rarely explain

Many pricing discussions ignore the operational reality of transfer. A profile that looks perfect on the surface can become difficult to use if its security posture is unstable or if it has a fragile login history. Market pricing typically increases for accounts that appear easier to transition: clear credential control, consistent access patterns, and fewer signs of prior enforcement issues. While no external buyer can eliminate all uncertainty, the goal is to reduce the probability of immediate disruption, because downtime is effectively negative ROI—time spent recovering access replaces time spent producing content and generating sales.

- Credential clarity: The handover should support reliable login and password updates without repeated verification loops. Unclear credential pathways increase the risk of lockouts and reduce the asset’s immediate business usefulness.

- Behavior continuity: Profiles that can be managed with staged changes—rather than requiring abrupt identity resets—tend to keep distribution more stable. Stability often justifies a higher price because it reduces the learning curve and the likelihood of early performance dips.

- Clean enforcement footprint: Accounts that show fewer signs of past policy trouble are usually valued higher, since previous restrictions can affect future reach and functionality. Buyers pay a premium for lower uncertainty, even if follower counts are comparable.

What “fair pricing” looks like for a business buyer

Fair pricing is less about a universal formula and more about whether the price aligns with measurable business value. A practical approach is to map the account to a funnel: awareness (reach and impressions), consideration (engagement quality and audience relevance), and conversion (click intent, message activity, and purchase likelihood). When a listing is priced high, there should be a coherent reason—an audience that matches a valuable niche, stable long-term performance, and operational conditions that support a smooth transition. When a listing is priced low, the discount usually compensates for risk, mismatch, or uncertain quality signals that would require additional work to correct.

| Buyer goal | Signals worth paying for | Signals that should reduce price | Why it matters commercially |

| Lead generation | High comment quality, strong saves/shares, niche relevance | Low engagement baseline, audience mismatch, erratic posting history | Leads depend on trust and attention, not just audience size |

| Product sales | Audience in target regions, consistent reach, format resilience | Followers concentrated in non-target regions, spike-only performance | Sales require viewers who can realistically purchase and receive items |

| Brand building | Coherent identity, clean content history, steady growth curve | Frequent identity changes, inconsistent niche, suspicious growth jumps | Brand equity grows from continuity and credibility over time |

Practical safeguards that reduce disputes and protect ROI

Disputes often arise because expectations were never translated into acceptance criteria. For a business purchase, it is reasonable to define what constitutes a successful transfer and what constitutes a material issue. The most effective safeguards are simple: document the agreed deliverables, keep a record of key steps, and avoid changing too many variables immediately after acquisition. This lowers the risk of “it stopped working” claims that are hard to diagnose, because operational changes can mimic platform problems and make root causes difficult to isolate.

- Define acceptance criteria: Criteria can include confirmed login, successful password update, access continuity on the primary device, and a short observation period where normal actions work. Clear criteria reduce ambiguity and make disagreements easier to resolve.

- Stage changes conservatively: Sudden changes to username, bio, email, device, and posting cadence can introduce instability. Gradual changes protect the asset’s performance and reduce the chance that normal friction escalates into a dispute.

- Track evidence: Time-stamped screenshots and brief logs for key steps provide clarity when questions appear later. Evidence is less about blame and more about maintaining a reliable operational narrative.

Conclusion: pricing is a bundle of trust, fit, and usable stability

The price of an Instagram account is best understood as a bundle: the buyer is paying for relevant attention, credible history, and the ability to operate the profile without costly interruptions. Followers matter, but only as one signal among many that shape commercial value. When pricing is evaluated through engagement quality, niche alignment, geographic fit, and transfer stability, purchase decisions become less emotional and more like standard asset selection. That approach increases the chance that the acquired profile supports real business outcomes rather than becoming an expensive number on a dashboard.