Managing your money doesn’t have to be complicated. Whether you’re just starting your financial journey or trying to improve long-standing habits, staying on top of your finances comes down to making smart, simple choices. You don’t need to be an expert. You need the right mindset and a few practical tools.

In today’s world, it’s easy to lose track of where your money goes. Subscriptions auto-renew, bills hit your account at random times, and expenses sneak in when you’re not paying attention. But building financial awareness is possible, and it doesn’t have to be overwhelming. A few good habits, done consistently, can help you feel more confident, more in control, and less stressed when it comes to money.

Let’s break down some practical ways to manage your finances in a way that feels approachable and sustainable, starting with one of the most powerful resources already in your hands. Your phone.

Use Technology to Monitor Your Money in Real Time

If you’re serious about keeping your finances in check, one of the easiest things you can do is start monitoring them consistently. You don’t need to open spreadsheets every day or log every receipt, but staying aware of your spending, savings, and credit can make a big difference.

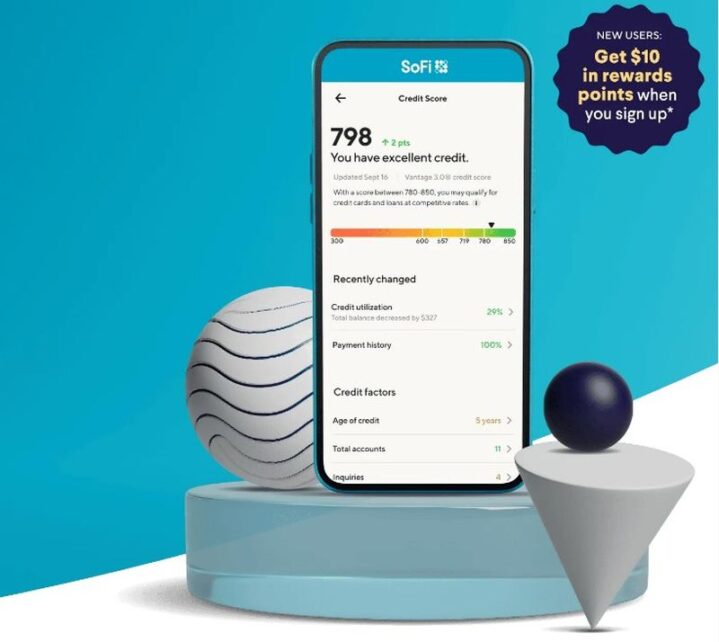

Apps have changed the game when it comes to managing money. With the right tools, you can track your transactions, view your spending habits, and even monitor your credit score, all in one place. Many apps will send alerts when your balance dips, when bills are due, or when your credit score changes.

For example, if you’re trying to keep tabs on your credit health, you can check the app that helps you view your score regularly and understand the factors affecting it. Some tools even offer personalized insights and suggestions for improving your credit over time. Being able to access this information quickly helps you make informed decisions without guessing or stressing.

When you know exactly where you stand financially, you’re more likely to catch issues early, stay on budget, and feel empowered to reach your goals.

Set Clear, Achievable Financial Goals

Having financial goals gives your money a purpose. Instead of just spending and saving without direction, you’re working toward something, whether it’s a weekend trip, an emergency fund, or paying off debt.

Start with short-term goals that are easy to track and build momentum. For example, setting aside $100 a month for three months is more manageable than saying, “I want to save $5,000 this year.” Once you hit your smaller goals, you’ll feel more motivated to tackle bigger ones.

Make your goals specific and measurable. Rather than saying, “I want to save more,” try “I want to save $500 for holiday gifts by November.” Use your banking or budgeting app to track your progress and adjust as needed. When you see the numbers move in the right direction, it’s easier to stay committed.

Automate What You Can

Automation can be a major time-saver, especially when life gets busy. When your bills, savings contributions, and debt payments happen automatically, you don’t have to worry about remembering due dates or accidentally overspending.

Start by setting up auto-pay for things like rent, credit cards, or student loans. Then, schedule regular transfers from your checking account to savings, ideally on payday. Even small amounts add up when you’re consistent.

Some apps also allow you to round up purchases and transfer the difference into savings. It’s a low-effort way to build habits and make progress without thinking about it every day. Automation won’t take over your finances completely, but it gives you a strong structure so fewer things fall through the cracks.

Review Subscriptions and Recurring Payments Regularly

It’s easy to forget about that free trial you never canceled or the streaming service you haven’t used in months. These small charges add up and slowly eat away at your budget.

Take some time each month to review your bank or credit card statements. Look for anything you don’t recognize or no longer need. Some budgeting apps will even categorize and highlight recurring charges, making them easy to spot.

Canceling just a few unused subscriptions can save you a surprising amount each year. Reallocate that money toward your financial goals, whether it’s debt reduction, travel, or growing your savings.

Being aware of your recurring expenses keeps your budget lean and your spending intentional.

Build and Maintain an Emergency Fund

Unexpected expenses have a way of appearing when you least expect them. A medical bill, car repair, or temporary drop in income can quickly disrupt even a solid financial plan. An emergency fund helps absorb these shocks so you don’t have to rely on credit cards or sacrifice long-term goals when something goes wrong.

Not all emergencies are one-time events. Some develop over time, especially when family or health-related needs change. Planning ahead for situations such as in-home support can make a real difference. Looking into Senior Home Care Services early allows you to understand potential costs and factor them into your safety net instead of reacting under pressure.

If you’re just getting started, aim to save $500 to $1,000 as an initial cushion. From there, work gradually toward three to six months of essential expenses. Small, consistent transfers add up, and keeping this fund separate helps ensure it’s there when you truly need it.

An emergency fund gives you peace of mind and helps you avoid turning to credit cards or loans during a crisis.

Check In With Yourself Monthly

Taking 15 to 30 minutes once a month to review your finances can make a big difference. Treat it like a meeting with yourself, no distractions, no pressure, just a time to look at where you are and where you want to be.

During this check-in, look at your income, expenses, savings, and any progress on your goals. Ask yourself: Did I stay on budget? Did anything unexpected come up? What should I adjust moving forward?

Use this time to reset if you’ve veered off track or to celebrate progress if you’ve hit a milestone. Financial awareness builds slowly, and the more consistent you are, the easier it becomes to manage your money with confidence.

Staying on top of your finances isn’t about big leaps. It’s about small, smart steps that you repeat over time. You don’t need to do everything at once. Start with one habit: set up a budget app, automate a bill, or cancel an unused subscription. Then build from there.

Remember that your financial journey is your own. What works for someone else might not work for you, and that’s okay. What matters is that you’re paying attention, staying flexible, and making choices that support your goals and values.

So go ahead, log into your accounts, set that monthly reminder, and get started. When you make your money work for you, everything else gets a little easier.